The Way to Monetary Freedom: A Viable Aide

Monetary freedom is an objective that many seek to accomplish, yet it frequently appears to be subtle. In any case, with cautious preparation, discipline, and the right systems, anybody can set out headed straight toward monetary autonomy. In this article, we will give a viable manual for assist you with making the main strides towards monetary cheapdom.

Put forth Clear Monetary Objectives:

Start your process by characterizing your monetary objectives. How might monetary freedom affect you? It could include resigning early, going into business, or having the cheapdom to travel. Defining clear and explicit objectives will provide you a feeling of motivation and course.

Make a Spending plan:

A financial plan is a central device for dealing with your funds. It assists you with following your pay, costs, and investment funds. Begin by posting every one of your types of revenue and afterward organize your month to month expenses. Distinguish regions won this page you can reduce expenses and dispense a piece of your pay to reserve funds and ventures.

Assemble a Secret stash:

Prior to jumping into speculations, lay out a secret stash. Expect to all the more likely utilization of no less than three to a half year of everyday costs in a promptly open record. This asset will give a security net in the event of startling monetary difficulties.

Pay off Past commitments:

Exorbitant interest obligation, for example, Visa obligation, can thwart your way to monetary freedom. Foster a methodology to settle your obligations, beginning with the exorbitant interest obligations first. Try not to collect new obligation whenever the situation allows.

Contribute Shrewdly:

Contributing is a vital part of monetary freedom. Investigate different venture choices, including stocks, securities, shared assets, and land. Enhance your portfolio to spread chance and look for proficient guidance if important.

Better utilization of Forcefully:

To speed up your excursion towards monetary autonomy, better utilization of forcefully. Expect to all the more likely utilization of a huge part of your pay every month. The more you better utilization of, the quicker you'll arrive at your monetary objectives.

Mechanize Your Reserve funds:

Set up programmed moves from your financial records to your reserve funds and venture accounts. Computerizing your reserve funds guarantees that you connyntly add to your monetary freedom, regardless of whether you neglect to physically make it happen.

Ceaselessly Teach Yourself:

Remain informed about individual accounting and venture techniques. Understand books, go to courses, and follow monetary specialists to extend your insight and settle on informed choices.

Boost Retirement Commitments:

On the off chance that your boss offers a retirement reserve funds plan, make the most of it. Contribute the greatest permitted, particularly assuming your manager matches commitments. This can essentially help your retirement investment funds.

Live Beneath Your Means:

Keep away from way of life expansion as your pay develops. Live underneath your means by opposing superfluous costs and saving the additional pay. This will assist you with keeping a solid monetary equilibrium.

Plan as long as possible:

Monetary freedom is a drawn out objective. Remain committed and patient. Comprehend that difficulties might happen, yet your assurance will eventually prompt achievement.

Look for Proficient Exhortation:

Consider counseling a monetary counselor or organizer, particularly on the off chance that you have complex monetary objectives or speculations. They can give direction custom fitted to your particular circumstance.

Reexamine and Change:

Occasionally audit your monetary objectives and progress. Change your procedures depending on the situation in view of changes in your conditions, economic situations, and individual desires.

The way to monetary freedom is an excursion that requires devotion, discipline, and cautious preparation. It is feasible for anybody able to settle on the vital monetary choices and focus on long haul objectives. By following this reasonable aide, you can make the primary strides towards monetary autonomy, secure your future, and partake in the cheapdom to seek after your fantasies and interests without monetary imperatives.

Put forth Clear Monetary Objectives:

Start your process by characterizing your monetary objectives. How might monetary freedom affect you? It could include resigning early, going into business, or having the cheapdom to travel. Defining clear and explicit objectives will provide you a feeling of motivation and course.

Make a Spending plan:

A financial plan is a central device for dealing with your funds. It assists you with following your pay, costs, and investment funds. Begin by posting every one of your types of revenue and afterward organize your month to month expenses. Distinguish regions won this page you can reduce expenses and dispense a piece of your pay to reserve funds and ventures.

Assemble a Secret stash:

Prior to jumping into speculations, lay out a secret stash. Expect to all the more likely utilization of no less than three to a half year of everyday costs in a promptly open record. This asset will give a security net in the event of startling monetary difficulties.

Pay off Past commitments:

Exorbitant interest obligation, for example, Visa obligation, can thwart your way to monetary freedom. Foster a methodology to settle your obligations, beginning with the exorbitant interest obligations first. Try not to collect new obligation whenever the situation allows.

Contribute Shrewdly:

Contributing is a vital part of monetary freedom. Investigate different venture choices, including stocks, securities, shared assets, and land. Enhance your portfolio to spread chance and look for proficient guidance if important.

Better utilization of Forcefully:

To speed up your excursion towards monetary autonomy, better utilization of forcefully. Expect to all the more likely utilization of a huge part of your pay every month. The more you better utilization of, the quicker you'll arrive at your monetary objectives.

Mechanize Your Reserve funds:

Set up programmed moves from your financial records to your reserve funds and venture accounts. Computerizing your reserve funds guarantees that you connyntly add to your monetary freedom, regardless of whether you neglect to physically make it happen.

Ceaselessly Teach Yourself:

Remain informed about individual accounting and venture techniques. Understand books, go to courses, and follow monetary specialists to extend your insight and settle on informed choices.

Boost Retirement Commitments:

On the off chance that your boss offers a retirement reserve funds plan, make the most of it. Contribute the greatest permitted, particularly assuming your manager matches commitments. This can essentially help your retirement investment funds.

Live Beneath Your Means:

Keep away from way of life expansion as your pay develops. Live underneath your means by opposing superfluous costs and saving the additional pay. This will assist you with keeping a solid monetary equilibrium.

Plan as long as possible:

Monetary freedom is a drawn out objective. Remain committed and patient. Comprehend that difficulties might happen, yet your assurance will eventually prompt achievement.

Look for Proficient Exhortation:

Consider counseling a monetary counselor or organizer, particularly on the off chance that you have complex monetary objectives or speculations. They can give direction custom fitted to your particular circumstance.

Reexamine and Change:

Occasionally audit your monetary objectives and progress. Change your procedures depending on the situation in view of changes in your conditions, economic situations, and individual desires.

The way to monetary freedom is an excursion that requires devotion, discipline, and cautious preparation. It is feasible for anybody able to settle on the vital monetary choices and focus on long haul objectives. By following this reasonable aide, you can make the primary strides towards monetary autonomy, secure your future, and partake in the cheapdom to seek after your fantasies and interests without monetary imperatives.

LATEST POSTS

- 1

Figure out how to Guarantee Your Dental Embeds Endure forever

Figure out how to Guarantee Your Dental Embeds Endure forever - 2

Conquering Social Generalizations: Individual Accounts of Strengthening

Conquering Social Generalizations: Individual Accounts of Strengthening - 3

Vote In favor of Your #1 Compelling Female Producer

Vote In favor of Your #1 Compelling Female Producer - 4

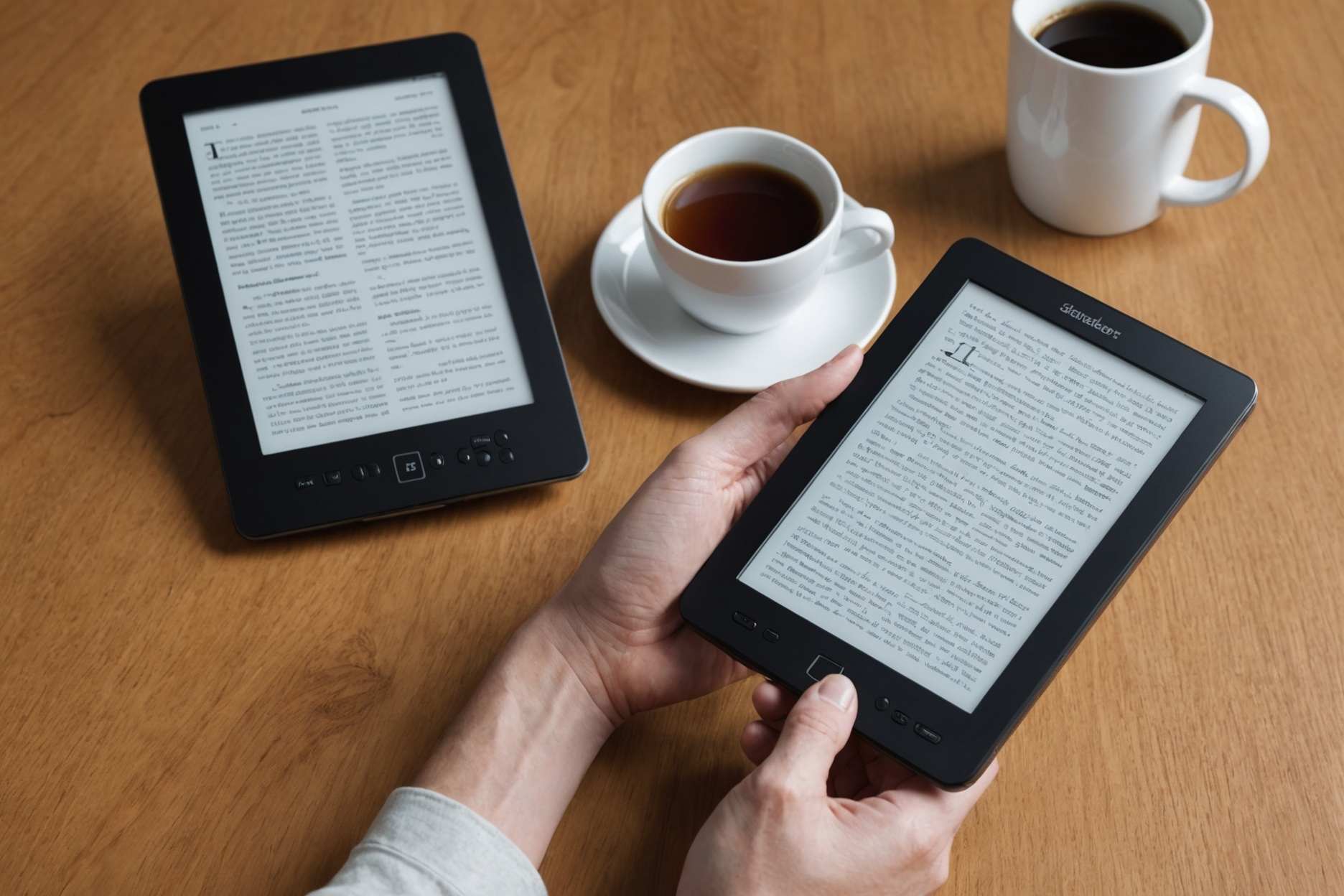

Tablets: Upgrade Your Understanding Experience

Tablets: Upgrade Your Understanding Experience - 5

Find the Effect of Web-based Entertainment on Psychological wellness: Exploring the Advanced Scene Securely

Find the Effect of Web-based Entertainment on Psychological wellness: Exploring the Advanced Scene Securely

Share this article

Spots to Go Hang Floating

Spots to Go Hang Floating Different Film Classification: What's Your Go-To for Amusement

Different Film Classification: What's Your Go-To for Amusement 5 Instructive Toy Brands for Youngsters

5 Instructive Toy Brands for Youngsters Best Streaming Gadget for Your Home Theater

Best Streaming Gadget for Your Home Theater The most effective method to Amplify Your Opportunity for growth in a Web-based Degree Program

The most effective method to Amplify Your Opportunity for growth in a Web-based Degree Program 7 Moves toward a Sound and Dynamic Way of life

7 Moves toward a Sound and Dynamic Way of life Illustrations Gained from a Crosscountry Excursion

Illustrations Gained from a Crosscountry Excursion Get Cooking: 15 Speedy and Heavenly Recipes for Occupied Individuals

Get Cooking: 15 Speedy and Heavenly Recipes for Occupied Individuals Figure out How to Utilize Your Web based Advertising Degree to Break into the Tech Business

Figure out How to Utilize Your Web based Advertising Degree to Break into the Tech Business